what is a lottery tax credit

Lottery proceeds are paid into a separate segregated state. The Lottery and Gaming Credit is determined in November of each year and depends on the amount of revenues from the lottery pari-mutual on-track betting and bingo during the year.

Property Owners Receive Increased Lottery Credit Wausau Times

The value of a tax credit depends on the nature.

. The Division of Taxation has created this webpage specifically for the. Browse reviews directions phone numbers and more info on Tax Credits LLC. A registered office address of Tax Credits is 242 Old New Brunswick SUITE 145 Piscataway NJ 08854.

The amount of the credit is based upon the school district in which your primary residence is located. The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery. We do accept credit cards for payment of taxes.

If the MCTMT amount exceeds the New York State tax and New York City Unincorporated Business Tax UBT taxpayers may. The highest federal tax bracket is 37. Lottery Gaming Credit for Kenosha County Residents.

Depending on where you live you may need to pay taxes on lottery winnings to your state and local governments in addition to the. The lottery credit is a State property tax credit for people that own their primary residence. The average credit for 2020-21 is 160.

Most prize winners pay a fixed federal income tax rate of 24 on their lottery winnings over 59999. Tax Credits LLC can be contacted at 732 885-2930. Only Wisconsin residents are allowed to claim the Lottery and Gaming Credit.

For example property owners are eligible for a lottery credit in 2021 if they owned. There is a 239 fee charged by our vendor Point Pay. The lottery credit is a State property tax credit for people that own their primary residence.

Another office of the organization is located at 45 Knightsbridge Rd Piscataway NJ. New Jersey can be included in the New Jersey credit calculation. However if your newfound wealth puts you in the top tax bracket this rate increases.

If a taxpayer pays their taxes in two or more installments the. The tax rate on lottery winnings depends on your income tax bracket. The Lottery and Gaming Credit is a credit that provides direct property tax relief to qualifying taxpayers on their property tax bills.

The 37 tax rate applies to income of about 500000 or more. Jan 11 2022 New Jersey S259 2022-2023. The lottery and gaming credit is shown on tax bills as a reduction of property taxes due.

Tax Credits LLC is located at 45 Knightsbridge Rd Piscataway NJ 08854. A tax credit is an amount of money that taxpayers are permitted to subtract from taxes owed to their government. Once you have applied for and received the lottery and gaming credit you do not need to file another application until your primary.

Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854. What is the tax rate for lottery winnings. Get Tax Credits LLC reviews ratings business hours phone.

The Lottery and Gaming Credit is a credit that provides direct property tax relief to qualifying taxpayers on their property tax billsLottery proceeds are paid into a separate. Since the programs 1971 inception. We are not able to absorb this fee into our budget so it must be paid.

6 Tax Financial Tips For The Next Lottery Millionaire Don T Mess With Taxes

How Are Lottery Winnings Taxed Blog Casey Peterson Ltd

R I Commission Releases List Of Historic Tax Credit Lottery Winners

No State Tax Windfall From The Powerball Jackpot The Hill

Fiscal Facts Tax Policy Center

Top 5 Best And Worst States To Win The Lottery

Cfc Tax Credits Make Up Artists Hair Stylists Guild Local 706

Final California Tv Tax Credits Lottery Selects 18 Projects

If You Win The 630 Million Mega Millions Jackpot Here S The Tax Bill

What Is A Lottery Tax With Pictures

5 Tax Tips For Lottery Winners Don T Mess With Taxes

Can I Claim Lottery Scratch Offs On My Taxes

Taxes On Lottery Winnings In Kentucky Sapling

The Economics Of The Lottery Smartasset

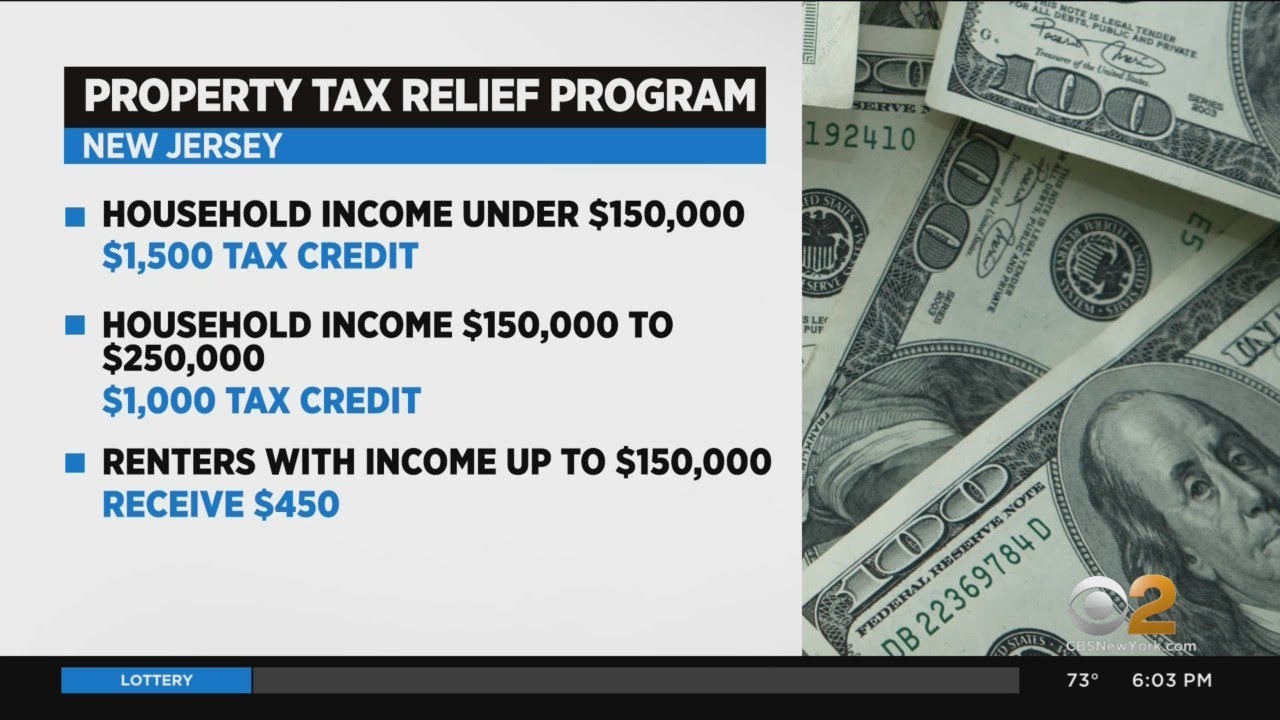

Millions Could Receive Property Tax Relief In New Jersey Youtube

Here S How Much The 1 Billion Mega Millions Winner Will Actually Take Home After Taxes

Final California Tv Film Tax Credit Lottery Hugely Over Subscribed